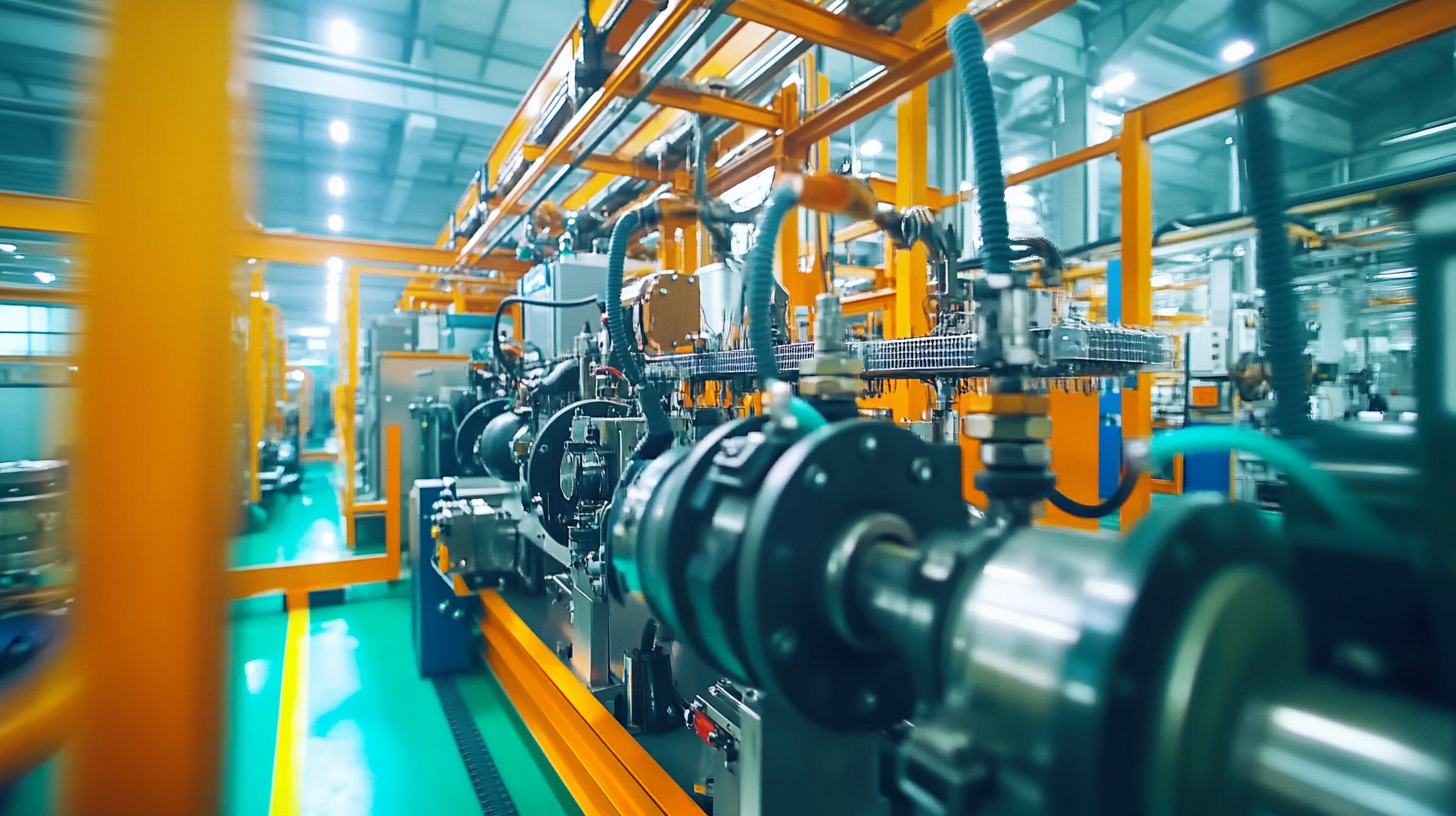

Amidst US-China Tariff Challenges, China's Eaton Hydraulic Pump Production Surges: A Statistical Insight

As global trade tensions escalate, particularly between the US and China, one sector that is defying the odds is China's Eaton Hydraulic Pump production. According to recent industry reports, the hydraulic pump market in China is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2028, demonstrating resilience amidst the backdrop of imposed tariffs. Eaton Corporation, a leading global manufacturer of hydraulic systems, has significantly ramped up its production capabilities in response to market demands. In 2023, China's Eaton Hydraulic Pump production reached an all-time high, contributing to approximately 45% of the total hydraulic pump manufacturing output in the region, underscoring the country's strategic positioning in the global supply chain. This surge in production not only highlights China's ability to innovate and adapt but also reflects the ongoing shifts in international trade and manufacturing dynamics.

Impact of US-China Tariffs on Manufacturing Landscape

The ongoing US-China tariff environment has created a complicated landscape for manufacturers, pushing companies to adapt quickly to the changing economic climate. Tariffs imposed on various goods have forced manufacturers to reevaluate their supply chains and cost structures. For China’s Eaton Hydraulic Pump production, this has led to significant internal adjustments and a focus on increasing output to maintain competitiveness. As companies look to navigate these challenges, understanding the impact of tariffs on production costs and pricing strategies becomes crucial.

It’s essential for manufacturers to analyze how tariffs affect not just material costs but also labor and logistics. One tip for companies is to diversify their supply chains to mitigate risks associated with tariffs. By sourcing materials from multiple countries, businesses can better shield themselves from sudden cost fluctuations. Another important strategy is investing in automation and efficiency improvements. Greater efficiency can help offset increased costs and maintain profitability despite the external tariff pressures.

Furthermore, manufacturers should stay informed about the evolving tariff landscape. Keeping abreast of potential changes can provide opportunities to pivot business strategies effectively. Regularly assessing market demands and adjusting production accordingly can also lead to better resilience in the face of trade uncertainties.

Eaton's Strategic Adaptation to Evolving Trade Challenges

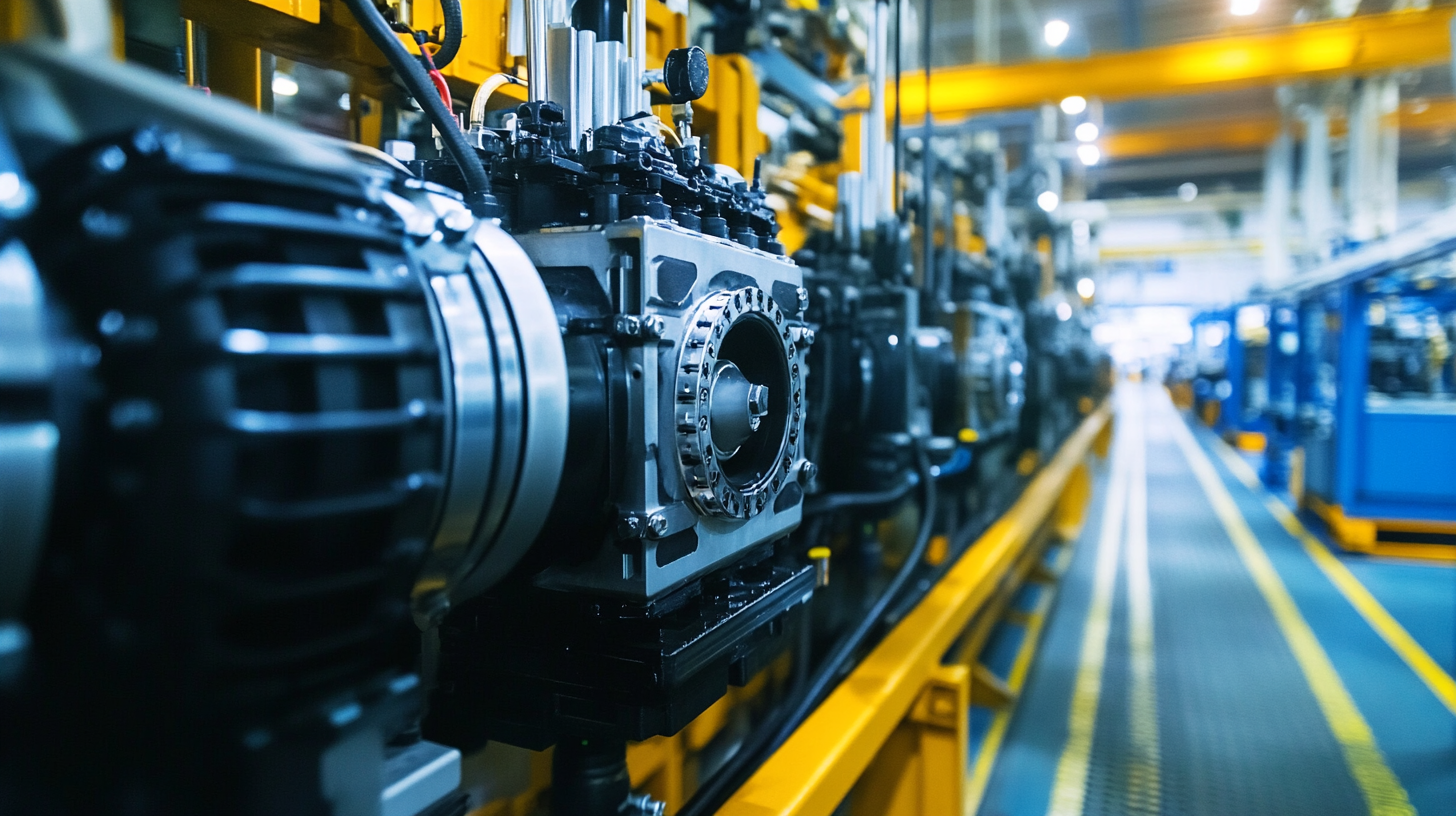

Eaton Corporation has taken proactive measures to navigate the turbulent waters created by US-China tariff challenges. By strategically adapting its production and operational frameworks, Eaton has managed to enhance its hydraulic pump manufacturing capabilities in China. This shift not only mitigates the impact of tariffs but also positions Eaton as a competitive player in the dynamic landscape of hydraulic and industrial machinery markets. The surge in production capacity reflects a keen understanding of market demands and an effort to maintain supply chain resilience amid external pressures.

Furthermore, Eaton's success in this context exemplifies how multinational corporations can leverage local production to buffer against geopolitical tensions. By investing in advanced technologies and optimizing local resources, Eaton ensures that it remains agile and responsive to customer needs. This adaptive strategy not only fosters growth within China but also reinforces the company's global brand presence, demonstrating the importance of flexibility in an ever-evolving trade environment. As the company continues to innovate and expand, it serves as a blueprint for others seeking to thrive despite challenging trade dynamics.

Amidst US-China Tariff Challenges, China's Eaton Hydraulic Pump Production Surges

This bar chart illustrates the significant increase in the production of Eaton hydraulic pumps in China from 2019 to 2023, highlighting the company's strategic adaptation amidst ongoing US-China tariff challenges.

Statistical Growth: A Deep Dive into China's Hydraulic Pump Production

China's hydraulic pump production has seen a significant surge in recent years, despite the challenges posed by US-China tariff disputes. According to a report from the China Hydraulics Pneumatics & Seals Association, the country's hydraulic pump output reached over 2.5 million units in 2022, marking a 15% increase compared to the previous year. This growth reflects China's robust manufacturing capabilities and its strategic efforts to enhance technology and efficiency within the sector.

The demand for hydraulic pumps is expected to continue rising, driven by various industries such as construction, automotive, and manufacturing. A recent market analysis estimates that the hydraulic pump market in China will grow at a CAGR of 7.2% through 2026. This presents a significant opportunity for manufacturers to invest in advanced technologies, streamline production processes, and improve product quality.

**Tip:** For companies looking to enter or expand in the hydraulic pump market, it's crucial to leverage data analytics to understand market trends and customer needs. Staying updated with industry reports can help identify emerging opportunities and potential challenges in a rapidly evolving landscape.

Furthermore, strategic partnerships with local suppliers can enhance competitiveness and supply chain resilience. As China continues to evolve as a leading player in hydraulic pump manufacturing, businesses that adapt to the shifting dynamics are likely to thrive.

China's Hydraulic Pump Production by Type (2023)

Comparative Analysis: China's Manufacturing Resilience vs. Global Trends

In the face of escalating US-China tariff challenges, China's Eaton hydraulic pump production has demonstrated remarkable resilience, highlighting the country's ability to withstand global manufacturing pressures. This phenomenon can be attributed to several critical factors, including robust supply chain management, advanced manufacturing technologies, and a skilled workforce. China's strategic investments in automation and innovation have allowed companies to enhance production efficiency even in a turbulent trade environment, enabling industry players to meet both domestic and international demands effectively.

Conversely, global manufacturing trends show a shift towards diversification and localized production as businesses seek to minimize dependency on any single market. Many companies outside China are reevaluating their supply chains, exploring options within Southeast Asia and other regions to mitigate risks posed by tariffs and geopolitical tensions. This comparative analysis reveals that while China's manufacturing sector is thriving, it remains essential for global manufacturers to adapt strategically to navigate an ever-evolving landscape marked by uncertainty and competitive pressures. The contrasting strategies of resilience in China versus the recalibration of global manufacturing networks paint a complex picture of the current economic climate.

Future Prospects: The Evolution of the Hydraulic Pump Market Amidst Tariffs

As tariffs continue to reshape the landscape of international trade, the hydraulic pump market is witnessing a significant evolution, particularly in China. The increasing production of Eaton hydraulic pumps in China highlights the country's ability to adapt and thrive amidst these challenges. With a robust manufacturing infrastructure and a growing demand for hydraulic solutions across various industries, China is positioning itself as a key player in the global market. The surge in production not only reflects local capabilities but also an intention to mitigate the impacts of tariffs imposed on imports.

Looking forward, the prospects for the hydraulic pump market remain promising. As companies diversify their supply chains and seek alternative sources, China's role is likely to expand further. Innovations in hydraulic technology, driven by both domestic and international collaborations, are expected to enhance product offerings and efficiency. Coupled with strategic investments in research and development, the future points towards a more competitive hydraulic pump sector, ready to meet the diverse needs of industries from construction to agriculture. The intersection of tariff dynamics and production capabilities may very well redefine market strategies in the coming years, making adaptation the key to success.